DraftKings is the big absentee of Ontario’s online betting and gaming regulation, but the reason the group has given for not yet launching in the province are revealing of potentially broader and more basic issues such as content and product quality.

As Ontario’s online sports betting and casino market gets underway and The Score takes an early lead in the app downloads charts, the old adage ‘absentees are always wrong’ is one French-speaking Canadians might recognize.

While the uncertainty over whether Entain’s online betting and gaming brands would get licensed has ended; the group said its bwin and Party Casino/Poker brands as well as the Sports Interaction sportsbook it acquired for $174m in January will be licensed in the province, the biggest absentee of all in Ontario is DraftKings.

Downbeat

To be fair, CEO Jason Robins has always been downbeat about Ontario. During DraftKings’ most recent results call, he said the province was different to US states because there had “been a gray market there for many years”.

Added Robins: “A lot of the operators [we] will be competing with have already been operating in and have already had time to build customer bases. So as noted in last year’s Investor Day, we are not projecting the same level of market share in Ontario or in Canada in general that we are projecting in the U.S. because we don’t have that early mover advantage.”

Which is ironic considering how DraftKings has made so much use of the database of fantasy players it built up prior to the regulatory spread of sports betting in the US in recent years. But at least Robins is honest about the reasons for not wanting to compete too hard or invest significant budgets in Ontario.

The group told Wagers’ The Source: “DraftKings is working closely with provincial regulators to bring our top-rated mobile sportsbook and casino products to Ontario as soon as possible.”

Virgin territories

However, Robins’ admission about existing operators in the province is interesting in that he seems to be saying only ‘virgin’ jurisdictions that have not had gray market activity give DraftKings an opportunity to be a market leader.

But equally, his comments don’t say much about the quality, or rather ability, of DraftKings to truly compete with new entrants like FanDuel or The Score with content, features or functionalities, never mind attracting and retaining enough Ontario bettors to eat into the market shares of bet365 or Betway.

It also doesn’t bode well for the rest of Canada should DraftKings ever contemplate entering other provinces. Should British Columbia or Quebec decide to join Ontario in regulating their OSB and icasino sectors, DraftKings would surely be leaving a lot of revenue on the table if it adopts the same policy as the one it has taken in Ontario.

By the numbers

To get an idea of the sums involved, Paul Burns, CEO of the Canadian Gaming Association, said last week during ICE that prior to Ontario regualing, Canada’s “gray market was generating $1bn in GGR per year and half of that was from Ontario. We (the CGA) were telling regulators they were losing on all of that activity.”

Morgan Stanley yesterday said geolocation data suggested Ontario gross revenues were tracking at around $1.1bn, but added that there had been technical and KYC teething troubles and that not all offshore operators had yet moved onshore, while DraftKings is still absent for the time being.

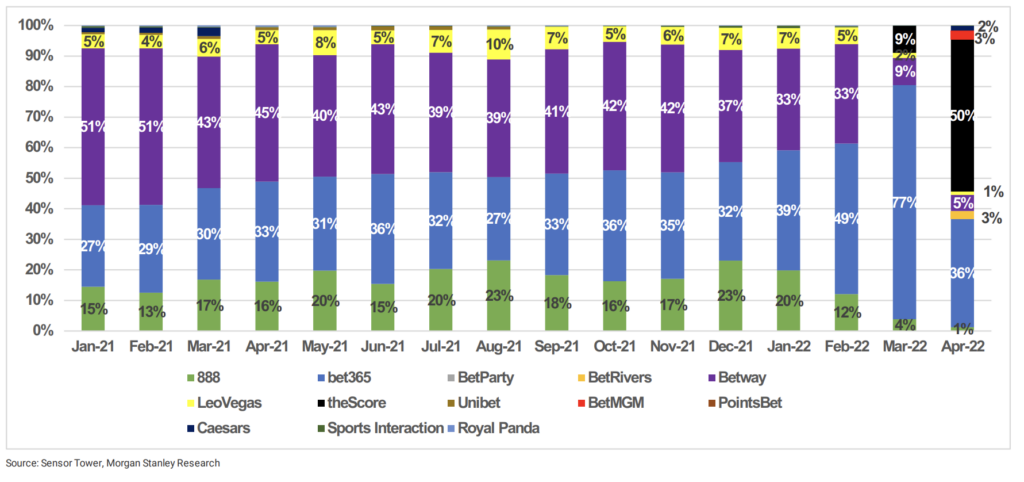

When it comes to market share, further data from Morgan Stanley on app downloads is revealing of the market conditions operators that were not previously active in the gray market are entering.

While TheScore leads the app download charts with 50% market share in the first two weeks of the licensed market, bet365 is second with 36% and Betway third with 5%.

The rest of the download charts read thus: as of April 14, bet365 and theScore led the way with ~78k in DAUs. Next up was Betway at ~43k, then FanDuel with ~30k followed by BetMGM (~14k), PointsBet and 888 (~5k each), then Caesars and BetRivers (~3k each).

For more context however the Sensor Tower/Morgan Stanley graph below also illustrates how Betway and bet365 have led the app downloads charts in the province for the past 15 months, with the latter clearly making a strong push in the month prior to regulation going live as it accrued 77% of betting app downloads in Ontario.

The team at Wells Fargo was positive on The Score, “especially given its two closest competitors had an advantage from their gray market presence.”

But equally Ontario is a market The Score can not afford to fail in considering the $2bn Penn National shelled out for it and the analysts pointed out that Ontario’s OSB share will evolve further in the coming weeks, notably as FanDuel got off to a similarly slow start in New York before powering into the lead later on.

“We note that the three current DAU leaders all had an existing presence in Ontario before April 4th; bet365 and Betway operated in the gray market, and theScore was a leading sports/media app that was awarded a license earlier than many competitors and may be beneting from pre-registration, which began roughly two weeks prior to launch,” said Wells Fargo.

Last but not least

Last but not least Entain’s Sports Interaction will also enter the regulated OSB fray in Ontario. Industry contacts confirmed it had applied for a license in the province, probably through gnashed teeth and at the behest of Entain.

No doubt its new owners told them that it had to happen, but for a company that up to the Entain takeover had been operated and run by the Mohawk Gaming Council out of Kahnawake and had always made plain its opposition to Ontario’s regulation, it must rankle. But at least it will be another powerful competitor vying for market share in the province.