Since the January debut of mobile sports betting, New York has posted some impressive handle and revenue numbers. New York is one of the newest mobile betting states in the country and already making its mark as one of the top-performing states in the nation.

And not just because of its population.

New York is also a topic of conversation due to the structure of its mobile sports betting industry, specifically the immense operator burdens that include a $25 million upfront licensing fee and a 51% tax rate with none of the deductions available to sportsbooks in other states.

Taken together, New York is thrilled with the tax revenue it is generating from mobile sports betting, even if operators are publicly decrying the market as currently structured is unsustainable.

How New York responds will play a pivotal role in determining what the US sports betting market looks like in the future.

New York’s Success Is a Double-Edged Sword

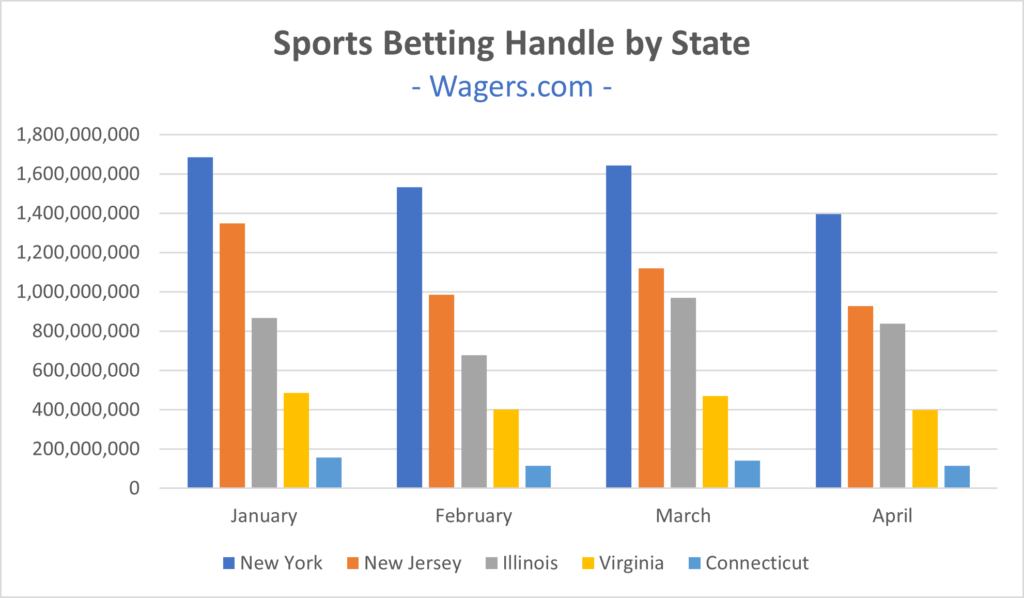

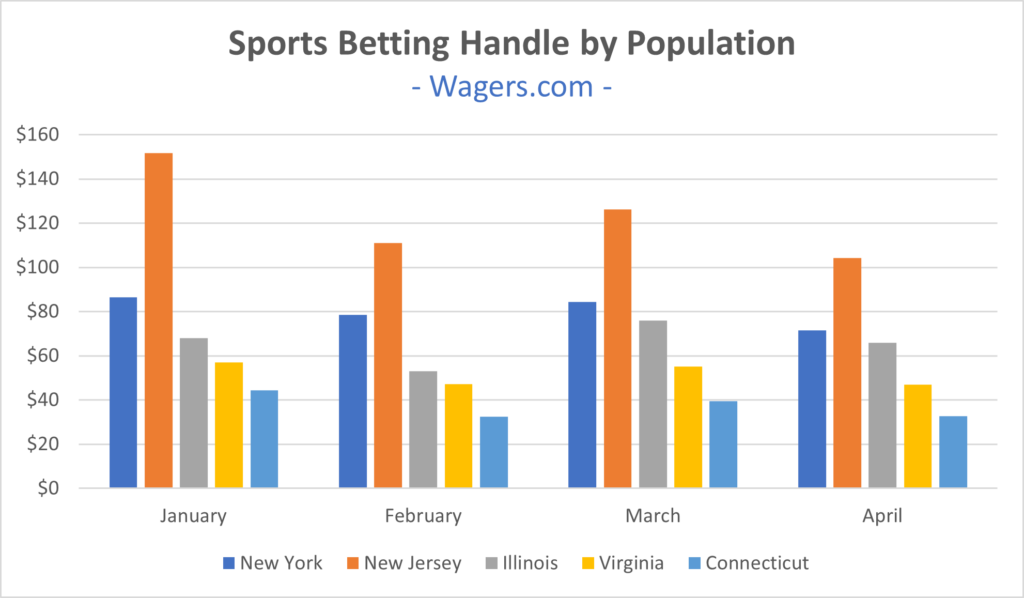

Because of its population, New York is easily the top state in betting handle.

When we look at handle per resident, New York only drops to the #2 spot behind New Jersey. A clear sign that the market’s performance is not a byproduct of population alone.

But that performance provides proponents of high-tax rates and operator burdens with a lot of fodder.

The Industry Is Winning Most of its Battles

Legal sports betting states number more than 30, and most have industry-friendly tax rates and licensing fees.

| Legal Sports Betting Market | Tax % (retail) | Tax % (mobile) | Effective Tax |

| Arizona | 8% | 10% | 3.6% |

| Arkansas[i] | 13%/20% | N/A | 14% |

| Colorado | 10% | 10% | 4.5% |

| Connecticut | 13.75% | 13.75% | 10.5% |

| Delaware | 50% | 50% | 51.4% |

| Illinois[ii] | 15% | 15% | 15% |

| Indiana | 9.5% | 9.5% | 9.5% |

| Iowa | 6.75% | 6.75% | 7.3% |

| Kansas | 10% | 10% | |

| Louisiana | 10% | 15% | 10% (retail-only) |

| Maine | 10% | 16% | |

| Maryland | 15% | 15% | 14.8% (retail-only) |

| Michigan | 8.4% | 8.4% | 2.5% |

| Mississippi | 12% | N/A | 12% |

| Montana[iii] | Varies | Varies | – |

| Nevada | 6.75% | 6.75% | 6.75% |

| New Hampshire | 51% | 51% | 46.2% |

| New Jersey | 8.5% | 13% | 12.4% |

| New Mexico[iv] | Varies | Varies | – |

| New York | 10% | 51% | 42.3% |

| Ohio | 10% | 10% | |

| Oregon[v] | Varies | Varies | – |

| Pennsylvania | 36% | 36% | 23.6% |

| Rhode Island | 51% | 51% | 51% |

| South Dakota | 9% | N/A | 9% |

| Tennessee | N/A | 20% | 16.9% |

| Virginia | 15% | 15% | 7.1% |

| Washington DC | 10% | 10% | 10% |

| West Virginia | 10% | 10% | 8.5% |

| Wyoming | N/A | 10% | 3.1% |

The problem (at least from the industry’s perspective) is what is yet to come? What happens if the remaining states follow in New York’s footsteps?

Massachusetts is having that debate, with New York getting name-dropped during the debate in the Senate:

“Before the vote, Sen. Bruce Tarr took to the floor to argue the state’s 35% tax on mobile wagering would make it uncompetitive in the market. Sen. Michael Rodrigues delivered the rebuttal, pointing to neighboring states and noting the tax rate in New York, New Hampshire, and Rhode Island is 50-51%.”

More importantly, the most populous states in the country (Florida, Texas, and California) are still sitting on the mobile sports betting sideline.

So, while the industry has done an excellent job of creating viable markets in most states, it’s track-record in heavily populated states isn’t as impressive, with a 51% rate in New York (fourth in population) and a 36% rate in Pennsylvania (fifth in population).

That’s important because Florida, Texas, California, New York, and Pennsylvania account for roughly 40% of the total US population (around 125 million residents). All five could wind up being difficult markets for sports betting operators. Toss in Rhode Island, New Hampshire, Delaware, and perhaps Massachusetts and a few other states, and suddenly 50% of the US population lives in a state with high operator burdens.

Bottom line: The industry could win 40 (out of 50) battles in the fight for US sports betting and still lose the war.

Let’s Take a Second Look at That

And then, there is the possibility of existing sports betting states revisiting their tax rates or eliminating promotional deductions to increase their tax revenue.

Virginia is already showing signs of buyer’s remorse. As the Virginia Times-Dispatch reported, the promotional write-offs negate 43.7% of the revenue Virginia’s government could tax.” The Virginia legislature also considered eliminating promotional deductions in 2022.

Colorado passed legislation limiting promotional deductions in 2022. As Wagers.com previously reported:

“The legislation will lower promotional deductions over four phases. Phase 1 limits promotional deduction to 2.5% of handle beginning January 1, 2023. In Phase 2 (July 2024), promotional deductions are limited to 2.25%. In July 2025, promo deduction is limited to 2%, and 12 months later, in July 2026, promo deductions permanently settle at 1.75%.”

[i] 13% on the first $150 million, 20% above $150 million

[ii] +2% for sportsbooks in Cook County and +2% for sportsbooks in Chicago

[iii] Montana keeps all revenues from sports betting with sales agents receiving 6% of total handle

[iv] New Mexico’s sports betting reporting doesn’t specify tax revenue

[v] The Oregon Lottery runs the state’s sports betting industry