The analysts at Jefferies have gone over DraftKings’ recent first quarter numbers and say “the current risk/reward for DKNG shares is highly favorable” and placed a price target of $33 on the group’s shares.

In its note, Jefferies says it is “revisiting our thesis and valuation” because “over the past 12 months, the sentiment around digital wagering in North America has shifted dramatically.

This was due to:

“1) more competitive landscape than expected,

2) legislative momentum and structure,

3) magnitude of cash burn and path to profitability, and

4) macro factors and sector rotation.”

With the marketing intensity from online sportsbooks exceeding initial expectations, the analysts maintain that DraftKings “is among the best positioned with a strong brand, first-mover advantage, resources, and strategic clarity”.

“To prove this point, despite the competition, DKNG has generally held on to >20% handle market share in key markets, and consistently scored well in our survey and brand matrix”.

Burning up

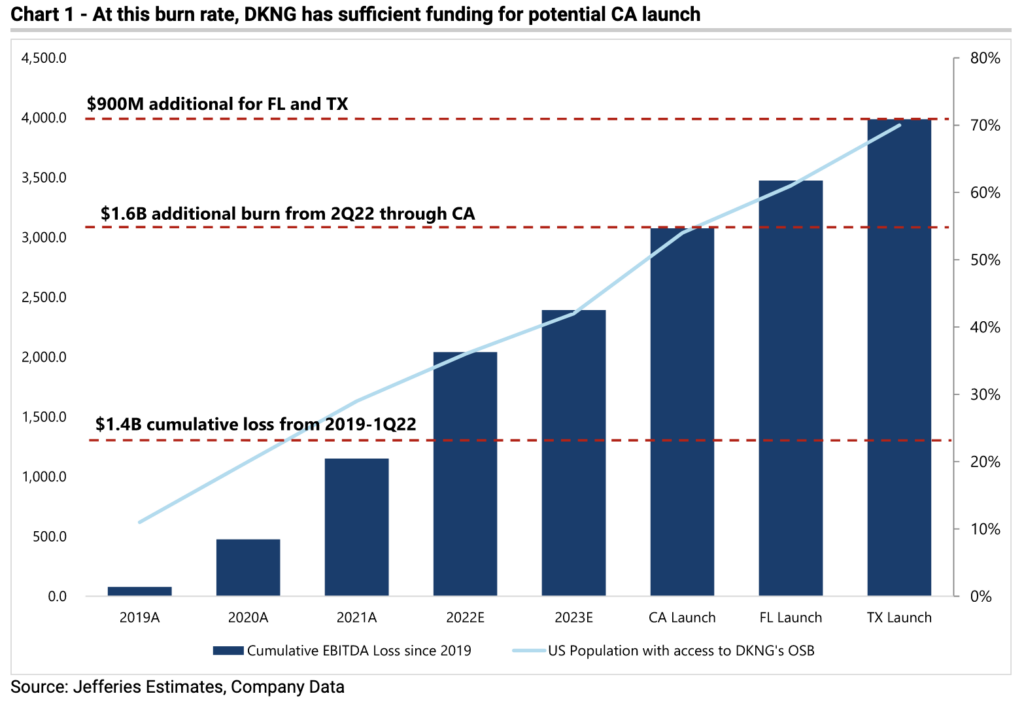

Jefferies says the “burning question” is whether DraftKings has “enough cash to support the EBITDA burn before turning to profit”, but the analysts also say that the thesis is “overblown”.

The company ended the first quarter of 2022 with $1.77bn of cash and a $1.265bn zero coupon convertible debt that will not mature until 2028 or become convertible in 2027.

Jefferies expects DraftKings to get through “approximately $950m” between now and the end of the year, to which can be added around $675m for any efforts related to California regulating sports betting. “At current burn rate, (we) believe the current cash balance is sufficient,” add the analysts.

Online casino to the rescue

DraftKings has had some success at cross-selling its sports bettors into its more profitable online casino products, but by its own admission it has not managed to do that as successfully as it wanted.

That explains why it decided to acquire Golden Nugget Online Gaming and with online casino gross revenue per capita trending at twice that of sports bettors’.

The economics of online casino are much more profitable than sports betting and less prone to unpredictable sporting results.

With that in mind, Jefferies says it expects half of the states with online sports betting to legalize online casino and maintains that “OSB and iGaming should each reach a total addressable market of $19bn at maturity”.

It adds that with the GNOG brand being stronger at acquiring icasino-only players thanks to its brick-and-mortar brand and database DraftKings will benefit from having this strong stand-alone online casino outlet and will also generate meaningful synergies of $300m from both revenue and marketing spend.

Upgraded forecasts

As a result, Jefferies has upgraded DraftKings’ full-year guidance to “$2.074bn of revenue vs. $1.946bn prior”. Adjusted EBITDA losses are expected to narrow slightly “to $890.3m vs. estimated losses of $922.6m, including investment in Ontario and GNOG”.

With regard to 2023, Jefferies says it expects DraftKings to record EBITDA losses of $351.2m vs. $290.1m.

However, these forecasts also depend on a number of scenarios happening, such as more states fast forwarding their legalization of online casino, marketing and promotional spend to moderate, the big states of California, Florida and Texas to regulate sports betting over the next few years, “while EBITDA burn moderates with economies of scale”.

Jefferies adds that DraftKings’ current cash balance is “sufficient to support launch in California without changing the playbook”.

The flipside of those positive outcomes is that those key states don’t legalize sports betting, take too long to do so or launch all at the same time thus bringing major extra marketing costs into the mix or that unfavorable tax rates or restrictions on mobile wagering limit the size of the total addressable market.