Evolution Q121

The top line

Revenues soared 105% YoY to €235.8m (32.8% QoQ rise). EBITDA up 150% to €160.1m (66.4% QoQ). Live casino (77% mix) accounted for the majority of revenue growth, up 60% YoY; RNG (33% mix) up 6% YoY. Integration with NetEnt completed nine months ahead of schedule.

All about the margin: The truly impressive number comes with YoY margins rising a whopping 1220 basis points to 67.9%. The margin improvement is ahead of expectations and was attributed to “continued high demand.” This will be improved further by the addition of Big Time Gaming (deal announced earlier in April, €450m cash and shares) which in 2020 achieved margins of 88% on revenues of €33m in 2020. For reference, EBITDA margin for FY20 was 59.2%.

Live casino continues to drive strong revenue growth at 60% annually and generated 77.9% of revenues per game type. Net Ent contributed 22.1% of revenues but growth of just 6%. Big Time Gaming had revenues of €33m in 2020 and EBITDA of €29m.

Think you’re Big Time: Speaking of Big Time Gaming, there was no hint of any change of strategy when it comes to Megaways licensing. On the earnings call, Carlesund said: “Of course, we see the potential for taking BTG into our distribution channels, which are bigger than what BTG has alone.”

When asked about the tension between wanting to be the number one supplier of online casino games and operators not wanting to be beholden to one large supplier, Carlesund replied:

“Evolution wants to be the best company, it’s not arrogant, we want to be humble but (we also) don’t understand why we can’t say that. We want to work with operators and expand the market, so that they see us as a partner”

Forward looking: Comparatives for the second quarter will provide a tougher challenge due to the “pandemic effects” on the NetEnt business in the prior year period.

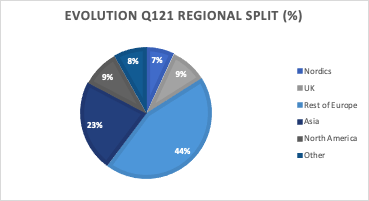

Regulation-lite: The geographic splits show growth across each region with the standout revenue increases coming from Asia (€53.2m compared with €20.8m in Q1 2020) and the US (€21.6m compared with €7.1m in Q1 2020). The addition of NetEnt has marginally improved the percentage of business form regulated markets, now at 40% (vs 38% in Q1 2020).

Europe generated 60% of group revenues during the quarter, with Asia (23%) in third and the US (9%) in third.

Responding to demand: Carlesund said the group was constantly looking at building new studio capacity to “increase supply and respond to demand. We’re building studios in Europe and the US to supply current demand, not (to target) a new state. The aim is to build a network of studios, build redundancy and increase reliability and stability.”

Responding to demand: Carlesund said the group was constantly looking at building new studio capacity to “increase supply and respond to demand. We’re building studios in Europe and the US to supply current demand, not (to target) a new state. The aim is to build a network of studios, build redundancy and increase reliability and stability.”Additional articles available today on Earnings + More:

- Super Group investor presentation

- XLMedia FY20

- Gaming Realms FY20

- Churchill Downs 1Q21 earnings call