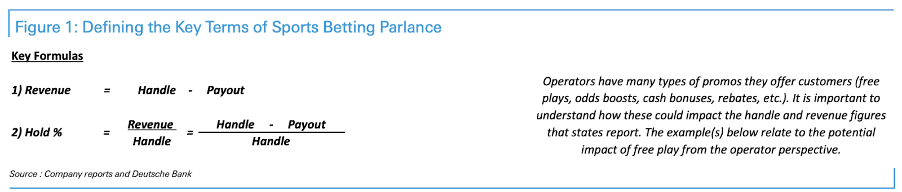

Are state revenues and hold figures for US online sports betting inaccurate and over-inflated? How does promotional spend, freebets mainly, but also odds boosts and rebates, really impact operators’ bottom lines? Wagers dives into the numbers.

The topic has been much debated on social media and among industry executives, but with DraftKings CFO Jason Park and CEO Jason Robins commenting on it recently, the team at Deutsche Bank dived into the details and examined the impact of bet promotions on states’ GGR numbers.

As mentioned, Jason Robins commented during DraftKings’ Q3 call with analysts that the “free bet doesn’t pay out the stake, so it inflates the hold rate versus odds boosts or other” promotions. “The impact from a GAAP perspective might be similar, but the state hold rate looks higher and the tax base looks higher. And that’s one of the factors we consider when deciding what types of promotions to run.”

Park pointed out that not only does every state have a “different definition of hold and handle (but) promotional mix really does get obfuscated in the state tax reports and, to the extent that an operator uses more free bets, that can really sort of make the state tax reports look like they have a higher hold percentage.”

Picking up on the comments, at the same time as adding a number of understandable caveats considering how promotional spend affects state and corporate figures, Deutsche Bank said working out the exact impact of promotions could be a lengthy and “elusive exercise” that could “lead to over estimating market sizes”.

Ratchet down promo spend

DB did add one line that seemed particularly relevant to OSB however. It said for sportsbooks the “path to profitability will almost undoubtedly require promotional levels to ratchet down considerably” and this “would have a meaningful impact on the handle and GGR results the market has come to rely on”.

Indeed, if state handle and GGR numbers are already overinflated by promotional spend and how it is accounted for (or not), logic would imply that we can expect those state and total addressable market numbers to drop once the market share/marketing arms race has abated in the next few years.

Although the flipside of that argument would be that with user and revenue numbers having settled as consolidation runs its course, sportsbooks also will be able to enjoy more stable and higher revenues.

In its note DB added that “the multiplier effect of a promotion will drive handle in excess of the aggregate promotional dollars doled out”, although key metrics will also “vary depending on the mix of promotions” such as freebets, odds boosts or other bonusing schemes.

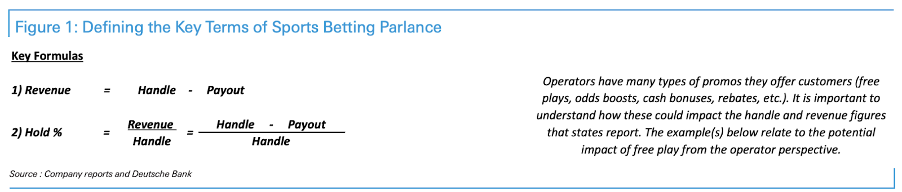

With freebets taken as the most widespread promotional tool, the DB team then lays out different scenarios where it assesses handle, GGR and hold levels:

It then assesses handle, GGR and hold percentage of freebets:

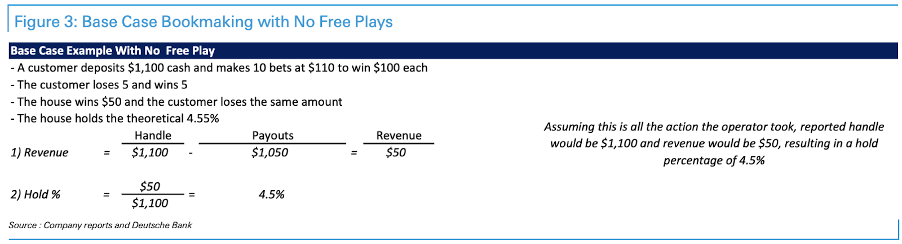

Running the base case for a bookmaker not offering freebets:

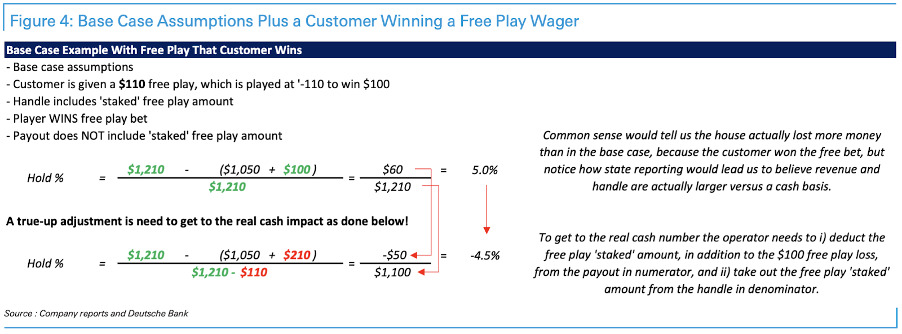

It then presents the case for customers winning or losing a freebet, starting with winning:

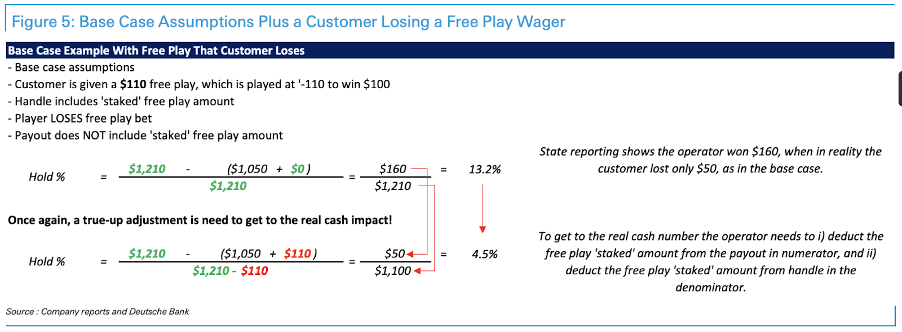

The scenario for a customer losing a freebet:

Tax matters

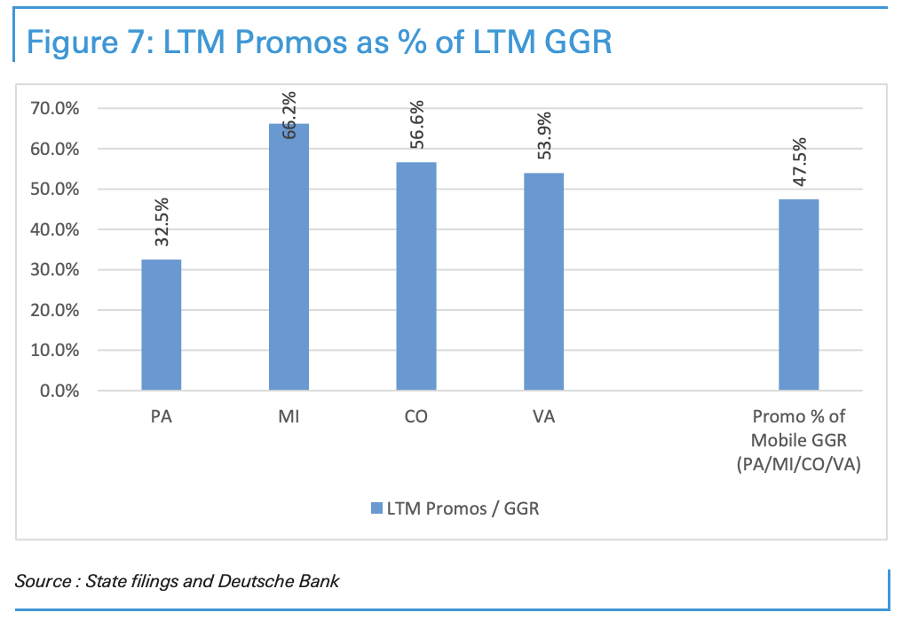

The exact impact of promos and promo mix on states’ handle and GGR will not get any clearer soon, but the team at DB points to states such as PA, MI, CO, and VA reporting GGR numbers that are “subsequently adjusted downward to account for promotional play”, thus providing some insight on the impact range of promotions.

In something of an understatement, it then adds: “As evidenced in September with the start of the NFL season, one can clearly see, promotions are not insignificant.”

The impact of the tax rate should also not be discounted. At 51%, the New York books are widely expected to cut down on over-generous promotions in an effort to balance their numbers.

Pennsylvania, with its high tax rate of 37%, confirms this. It has the lowest promotional spend as a percentage of its mobile betting GGR and as Barstool showed for October, gaining market share through heavy promotional spend still leads to losses in PA.

With just 40% of the US population having access to regulated sports betting at the moment, promotions will continue being an integral part of sportsbooks’ marketing mix for some time yet, but equally the analysis and focus on the numbers will also continue in parallel.