As sports betting proliferates across the U.S., its legislative successes stand in stark contrast to the six states that have legalized online casino gambling. Despite the lack of access to legal online casino sites, those six states tallied more than $3.7 billion in revenue in 2021. Two months in, and 2022 is on pace to obliterate that number.

After amassing nearly $400 million in January, the abbreviated month of February led to a slight month-over-month reduction in online casino revenue. However, the combined revenue in the six legal online casino states (including online poker where available) still exceeded $385 million.

Furthermore, on a per-day basis, February outperformed January in five of the six states and by a considerable margin overall.

| Jan. 2022 Rev. | Feb. 2022 Rev. | Jan. Rev. per day | Feb. Rev. per day | |

| New Jersey | $137,849,716 | $129,976,091 | $4,446,765 | $4,642,003 |

| Pennsylvania | $108,310,642 | $102,419,293 | $3,493,891 | $3,675,832 |

| Michigan | $121,243,501 | $122,775,924 | $3,911,080 | $4,384,854 |

| Connecticut | $22,473,594 | $21,582,925 | $724,954 | $770,818 |

| West Virginia | $6,832,236 | $8,013,328 | $220,394 | $286,190 |

| Delaware | $1,121,345 | $843,246 | $36,172 | $30,116 |

| TOTAL | $397,831,034 | $385,610,807 | $12,833,256 | $13,789,813 |

- Revenue numbers from the Michigan Gaming Control Board.

- Revenue numbers from the New Jersey Division of Gaming Enforcement.

- Revenue numbers from the Pennsylvania Gaming Control Board.

- Revenue numbers from the Delaware Lottery.

- Revenue numbers from the West Virginia Lottery.

- Revenue numbers from the Connecticut Department of Consumer Protection.

A Missed Opportunity

The six legal online casino states have a combined population of 37.9 million, accounting for just 11.5% of the total U.S. population. Were online casinos legal in all 50 states, the monthly online casino tally in the U.S. would be around $3.5 billion.

Bottom line: You would be hard-pressed to find a better example of the phrase “leaving money on the table” than the unwillingness of states to legalize online casino gambling. Even with a minimal tax of 15%, that works out to $525 million in tax revenue per month – to say nothing of the licensing fees, jobs and other indirect revenues.

A Look Inside the February Numbers

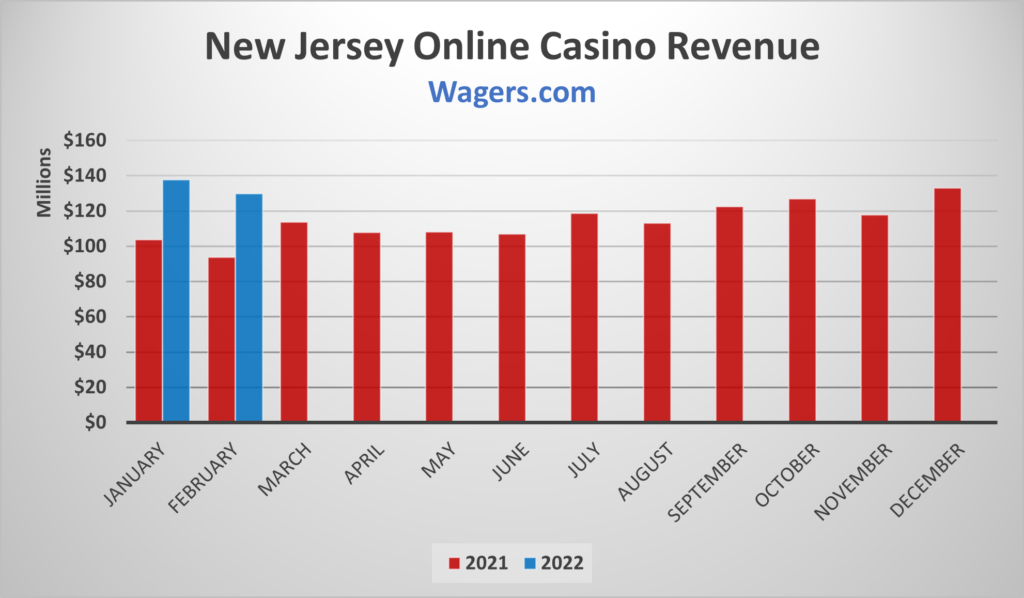

Does New Jersey Have a Ceiling?

New Jersey’s online casino industry is head and shoulders above its peers. The Garden State’s industry is nearly ten years old, yet it continues to post year-over-year gains. The New Jersey online gambling industry has never experienced a Y/Y decline in its entire history. And as the chart below shows, the growth is still substantial.

The question is, how has New Jersey pulled off this feat?

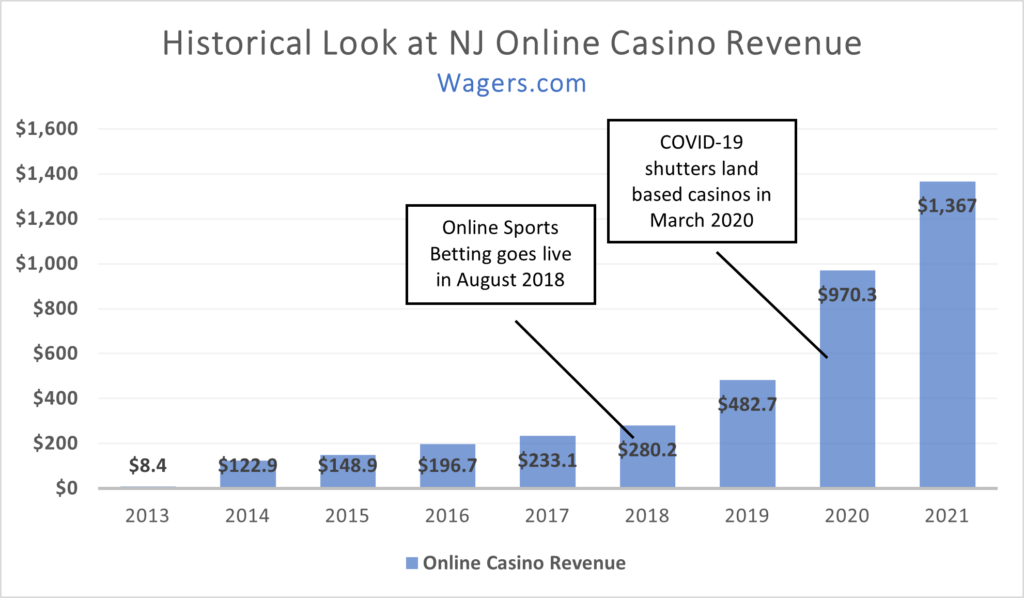

The following chart shows how the introduction of online sports betting and the COVID-19 pandemic acted as a one-two punch to supercharge New jersey’s online casino revenue.

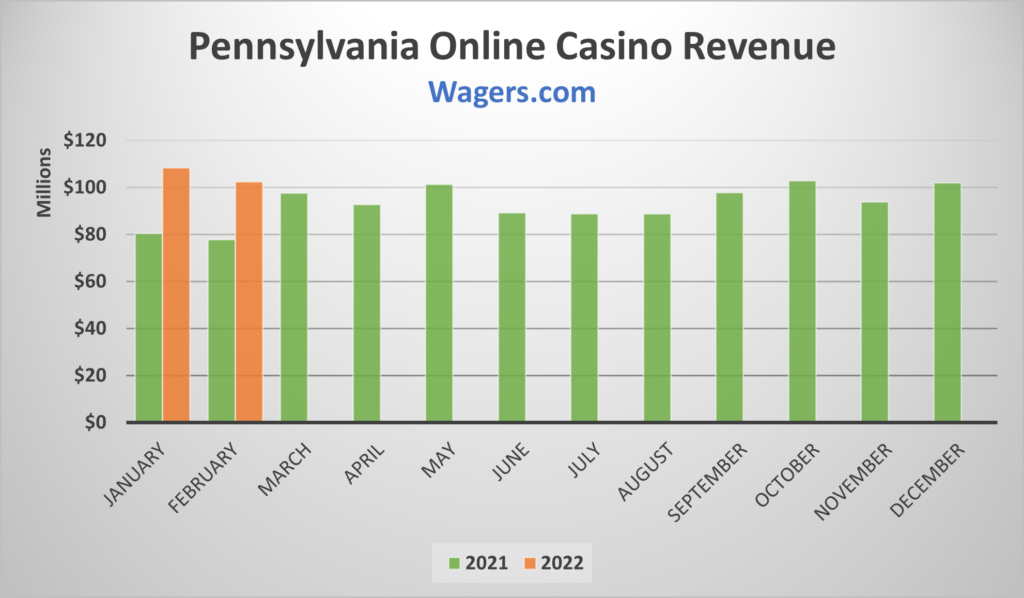

Pennsylvania Proves Policy Matters

Pennsylvania has also legalized online casinos, but it’s been unable to replicate its neighbor to the east’s success.

Pennsylvania has surpassed $100 million in online casino revenue in January and February, but despite a 25% population advantage, the Keystone State’s online casino revenue is just 75% of its neighbor.

The reason Pennsylvania hasn’t performed to New Jersey’s (or Michigan’s) level can be chalked up to policies. When it legalized online gambling in 2018, Pennsylvania imposed heavy burdens on operators, including hefty licensing fees, a 54% tax on online slot machines, in-state server requirements, limited online skins and branding requirements on those skins.

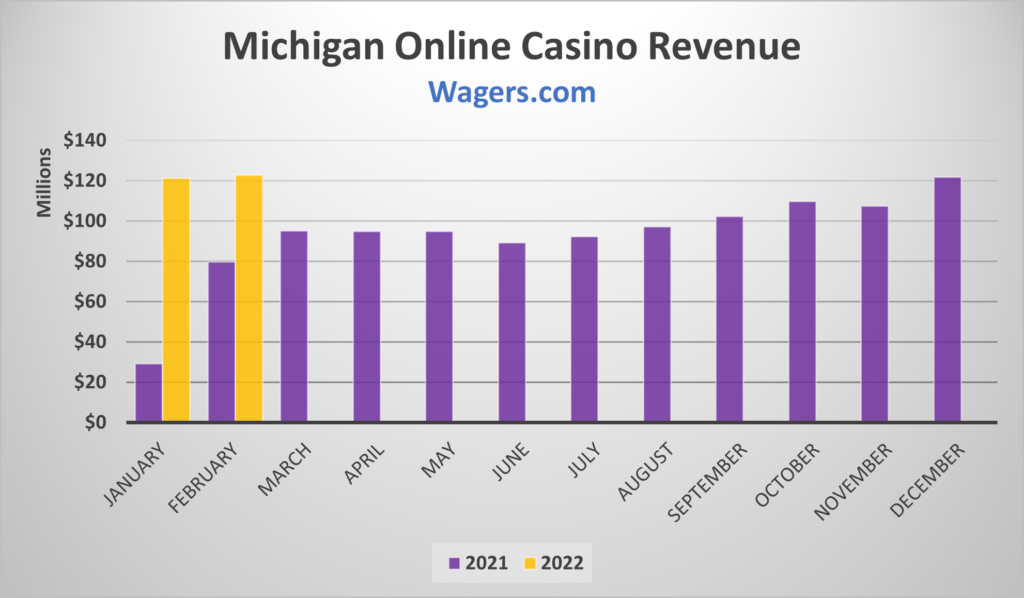

Michigan Starting to Surge

As Pennsylvania revenue has stalled, Michigan, which launched its online casino industry in January 2021, has been on an upward trajectory over the last six months, topping $120 million in each of the previous three months.

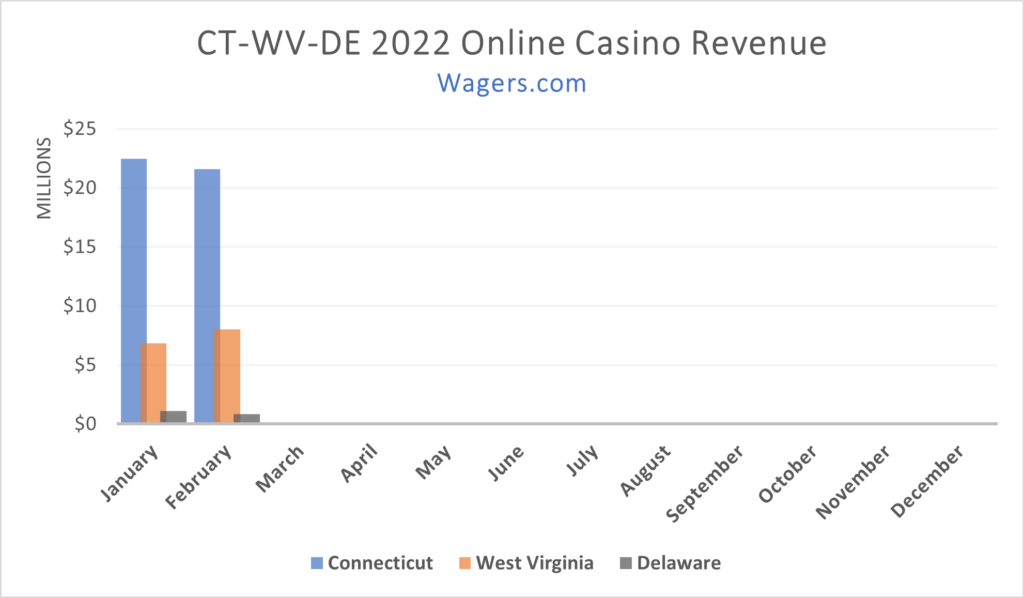

Don’t Forget About Connecticut (But Forget About Delaware)

The previous three states get the bulk of the headlines, but there are three other online casino states, although two are relatively inconsequential.

Connecticut is the newest online casino industry, having launched in October 2021, and it’s already outperforming West Virginia and Delaware (the oldest online casino state) by a considerable margin on a per-population basis and is nearly on par with Pennsylvania.

Per resident online casino revenue, February 2022:

- New Jersey = $14.60 per resident

- Michigan = $12.28 per resident

- Pennsylvania = $8 per resident

- Connecticut = $6.16 per resident

- West Virginia = $4.71 per resident

- Delaware = $.84 per resident

Delaware is the extreme outlier, and for a good reason. If Pennsylvania’s policies have acted as a restrictor plate on the industry, Delaware’s policies are analogous with four flat tires. Delaware is a lottery-run monopoly without a mobile app (desktop-only) that lacks incentives for the state’s three operators to market online gambling.

The state receives the first $3.75 million of industry-wide online gambling revenue by law. Revenue above $3.75 million is split between the state, the three casinos, and the horse racing industry. The casinos (the operators) receive 46.5% of online slot revenue and 66.1% of online table game revenue.

In 2021, Delaware’s online casinos generated $10.6 million. Subtracting the first $3,75 million the state receives leaves a total pot of $6.85 million, of which the casinos receive about 50%, for an average of $1.3 million each for the entire year.

There is simply no incentive for one of the three operators to invest even $500,000 into an advertising campaign based on the structure of the disbursements.