A recent note by the analysts at Jefferies says MGM could renew its attempt to acquire Entain in 2022. Wagers.com looks at the potential scenarios of how an MGM buyout of Entain might play out.

Entain has a 50% stake in the BetMGM joint venture that is performing strongly for MGM and the UK group and the rationale behind MGM wanting to acquire Entain is simple enough.

It would give the US casino giant full control of the BetMGM tech stack and, most importantly, 100% of its revenues, which Jefferies says came to $850m in 2021.

BetMGM performing strongly

The next 12 months are also promising, Jefferies has issued full year 2022 revenue guidance of more than $1.3bn for BetMGM, the brand is the number 2 US operator behind FanDuel for combined online sports betting and casino market share and number 1 for online casino.

The possibility of an MGM bid for Entain is not surprising, it comes on the back of the initial $11.7bn bid that it lodged in January 2021, and, of course, DraftKings attempting to acquire the UK group in September for $22.5bn.

Clearly MGM wants to avoid any repeat scenario where DraftKings appeared to catch it off guard, although that seems unlikely currently considering DKNG’s share price woes, but more intriguing would be how a potential MGM takeover of Entain would take shape.

The key questions would look something like this.

Would MGM acquire the whole of Entain and then sell off the group’s non-US assets in a similar way to what Caesars did with William Hill?

Yes, Caesars has done that with William Hill and Entain’s non-US business is substantial and would generate a strong cash injection thanks to leadership positions in key regulated markets such as the UK, Germany or Spain.

Could MGM acquire just the 50% of BetMGM that it doesn’t own?

Yes, but that scenario is complicated by the fact that BetMGM runs off the same tech stack as Entain’s bwin brand. Questions would then revolve around how either group would split the tech (and some staff?) and who would replace them.

Would Entain be interested in such an offer?

That would be up to its shareholders and various takeover committees.

For Entain, does that explain its decision to acquire Sports Interaction in Canada?

Maybe, and, indulging in some highly speculative thinking, its acquisition of the esports-focused operator Unikrn might have been driven by a desire to diversify geographically, while also not being encumbered by US regulatory ties following the disposal of BetMGM.

Speculation aside, Entain’s acquisition of Sports Interaction might have given it a foothold in North America, Canada specifically, but it also comes with a raft of regulatory issues that the group will have to face up to in the near future.

And finally, how much would Entain or the 50% of BetMGM cost?

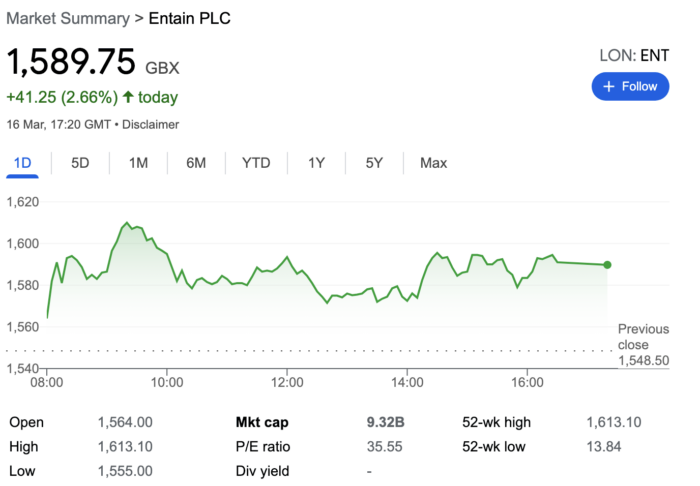

That’s a good question. Entain’s current market cap is around £9.3bn/$12bn, MGM bid $11.7bn for Entain in January 2021 and DraftKings’ September offer was for $22.5bn, which was a hefty 42% premium on Entain’s share price at the time. If sold separately, BetMGM’s valuation at the time would have ranged between $8bn and $14bn.

Total control

Having a strong tech stack has always been important for online sportsbooks, but the rise of OSB in the US has brought the issue of tech ownership and having all key bookmaking functions in-house into the sharpest focus.

For these reasons and the fact that it wants to keep 100% of the revenues that BetMGM generates, another MGM bid for Entain seems certain, even if the form it might take is anything but.

What is clear is that having total control of its tech stack, risk management or trading is as important now as it was in April last year when BetMGM held an investor conference to discuss its launch plans.

Asked about the issue of tech ownership and how MGM would navigate not being in total control, CEO Adam Greenblatt commented: “We have trading and risk management teams in Jersey City and Las Vegas. Entain is viewed as being in-house, we have exclusive use of that stack, are the only ones to use it and don’t have to buy in or plug in any other technology or components to operate it.”

At the time this reporter thought Greenblatt sounded somewhat defensive in his response, but that is understandable in light of the industry trends that have emerged since.