The Super Group financial details of their full-year results show how difficult it is to find the balance between regulated and unregulated revenues.

Operators make a great deal of working in regulated markets. However, the realities and costs of working in those markets are clear when looking at their revenue breakdowns.

The details from the parent company of the Betway and Spin brands’ full-year statement showed that:

- Revenues were up 45% YoY to €1.3bn and adjusted EBITDA was up 60% to €289.5m.

- The revenue mix was 65% casino, 29% sport, 6% other.

- The geographic split showed that North America made up 45% of the total, Asia 25%, Africa and the Middle East 17%, Europe 11%, and LatAm 2%.

The revenue breakdown shows that at around €594m, North America makes up close to half of Super Group’s revenues in 2021.

Canada high, Europe highly costly

Super Group is in the very early stages of expanding into the US. Currently, it is live in Iowa, Colorado, Indiana, Pennsylvania, New Jersey, and Arizona and has market access deals for a further 12 states.

But it has minimal share of market in the US. Canada, and specifically its online casino player base, is the significant revenue generator for the group.

Further detail shows that the company’s icasino brand Spin generated €463m of the €594m North America revenue total.

But it also reveals the real cost of sports sponsorship deals and doing business in the biggest regulated markets in Europe. Super Group is active in the UK, France, Sweden, Spain, and Italy.

And yet the region generated ‘just’ €160m in revenues in 2021.

This is despite the group working in some of those markets for many years. Its Betway brand has run many high-profile and no doubt costly sponsorships and betting partnerships with many major sports teams in those countries.

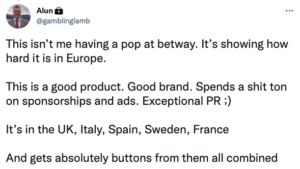

As industry observers have commentated:

Ontario license delay

Which is why the delay in getting licensed in Ontario is all the more surprising.

During the group’s call with analysts, CEO Neal Menashe said Betway and Spin are not yet licensed in the province but were still operating there.

He said it was in regular discussions with the Alcohol and Gaming Commission of Ontario with regard to obtaining its license.

Menashe added there would not be a blackout period or delay and the group would continue operating there while it waited for its license: “No delay from when you roll in from the dot com to local regulation,” he said.

The province is expected to be one of the most competitive markets in North America, but Menashe said the group would not jump into promotional wars in Ontario and would keep a tight rein on marketing costs.

“We’ve seen how New York has behaved with huge bonuses and no tax rebates on the spend. You can’t change strategy just because of a new market, Ontario is no different and remember it’s only one province in Canada.”

Online casino key

As mentioned above, the revenue breakdown shows how significant online casino revenues are to Super Group and this will no doubt play out in Ontario.

With leading US brands such as DraftKings mentioning how difficult they had found cross-selling sports bettors into casino products, Menashe said this was why it would continue to operate a dual-brand strategy, with Betway and Spin operating wherever possible.

“Generally across the world, specific igaming customers vs. sports betting are very different. Betway customers are very different to Spin customers and that’s why we have both brands and can attract each type of customer. That applies to Ontario and that’s why we move province by province.”

When it comes to geographic emphasis, Canada represents 45% of Super Group’s global revenues. The company will have its hands full in that market, starting with Ontario.