U.S. online casino revenue eclipsed $400 million for the second consecutive month in April. The six-state tally of $414.4 million is the second-highest total in the history of the U.S. industry. On a per-day basis, April was the best month of all time, outpacing February 2022’s $13,789,813 daily average.

| March 2022 Rev | April 2022 Rev | March Rev/day | April Rev/day | |

| New Jersey | $140,655,053 | $136,883,398 | $4,537,259 | $4,562,779 |

| Pennsylvania | $118,118,408 | $113,109,393 | $3,810,271 | $3,770,313 |

| Michigan | $131,673,653 | $132,438,011 | $4,247,537 | $4,414,600 |

| Connecticut | $22,637,711 | $22,757,263 | $730,248 | $758,575 |

| West Virginia | $10,343,361 | $8,036,257 | $333,656 | $267,875 |

| Delaware | $1,002,072 | $1,221,889 | $32,325 | $40,730 |

| TOTAL | $424,430,258 | $414,446,211 | $13,691,296 | $13,814,872 |

- Revenue numbers from the Michigan Gaming Control Board.

- Revenue numbers from the New Jersey Division of Gaming Enforcement.

- Revenue numbers from the Pennsylvania Gaming Control Board.

- Revenue numbers from the Delaware Lottery.

- Revenue numbers from the West Virginia Lottery.

- Revenue numbers from the Connecticut Department of Consumer Protection.

A Look Inside the April Numbers

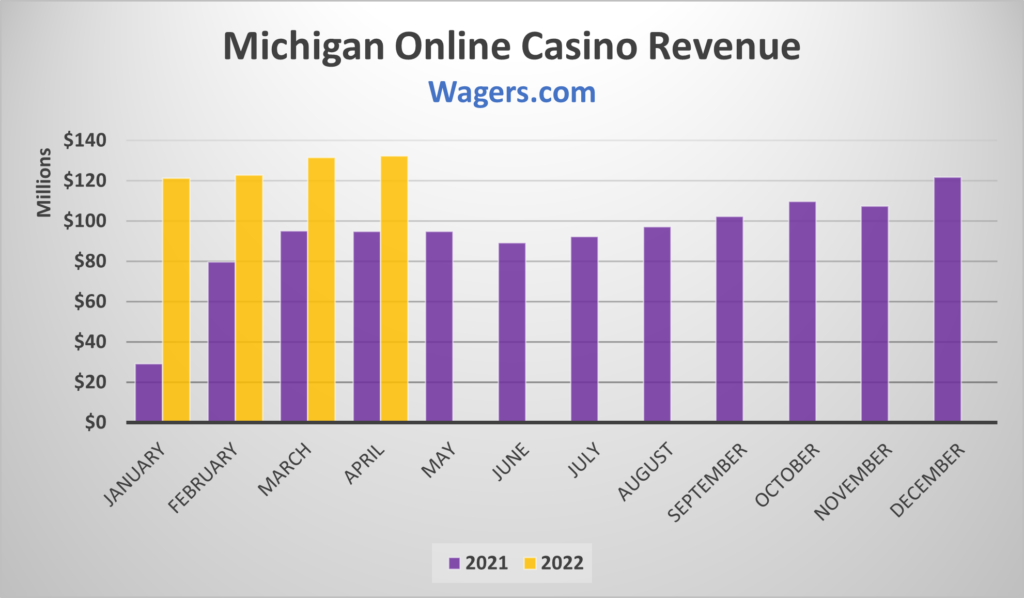

Michigan Poised to Overtake New Jersey

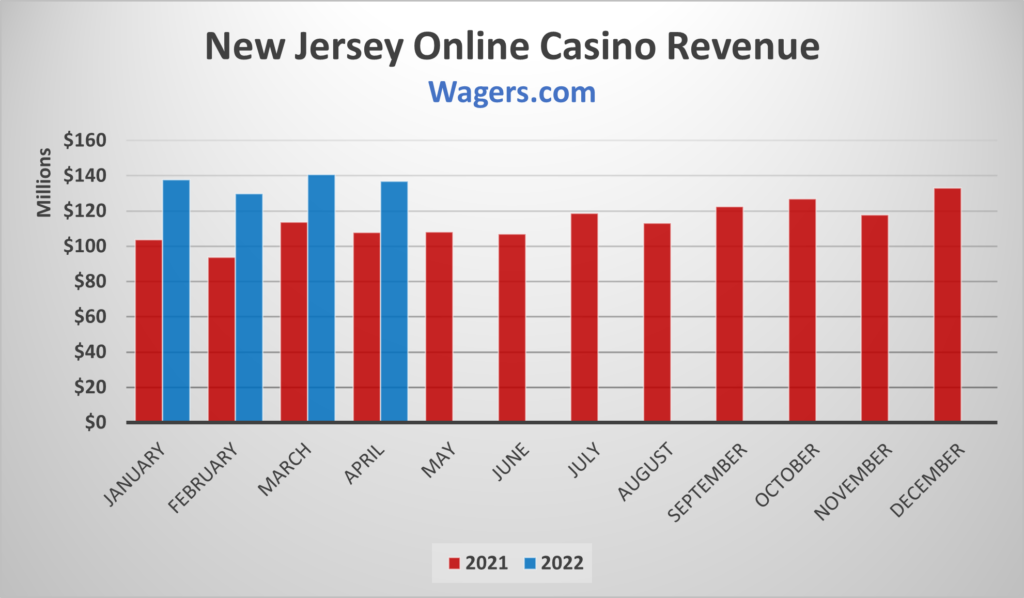

The gap between New Jersey and Michigan continued to close in April. After coming within 6% of New Jersey’s online casino revenue in February and March, Michigan narrowed the gap to less than 4% in April.

Year-over-year growth has slowed in New Jersey, coming in at 27% in April. That’s a significant increase over the 19% Y/Y growth in March, but well below the initial post-PASPA growth, consistently above 50%.

Michigan saw 40% Y/Y growth in April. If both states continue to trend in opposite directions, Michigan will soon become the US online casino leader.

Michigan Market Share

New Jersey’s top three operators (FanDuel, DraftKings, BetMGM) have a market share of 62%, according to Eilers & Krejcik Gaming analysis of January-March 2022. In Michigan, the same three operators had a near 70% market share in April.

There is also a more significant gap between the top operator, BetMGM, and the runners-up (DraftKings and FanDuel) in Michigan. BetMGM boasts a 37.2% market share in Michigan, while FanDuel and DraftKings possess a 16.1% market share. That’s a 21-point spread between number one and number two.

By comparison, in New Jersey, BetMGM has a market share of around 30%, with FanDuel and DraftKings coming in at around 15%.

Pennsylvania Continues to Lag

Pennsylvania is another solid online casino market, but the Keystone State is mining silver compared to the gold mines in New Jersey and Michigan. With a population advantage of 30% and 23%, respectively, Pennsylvania’s online casino revenue vastly underperforms both aforementioned states. As previously reported, tax burdens and other negative industry structures significantly contribute to Pennsylvania’s underperformance.

Pennsylvania is also seeing much slower Y/Y growth, coming in at 18% in April, after 17% Y/Y growth in March.

That said, Pennsylvania’s government coffers are filling far faster than New Jersey and Michigan thanks to Pennsylvania’s tax rate. With a 54% tax on slots and 16% on table games, Pennsylvania’s April 2022 tax haul was higher than the combined figure from New Jersey (15% tax) and Michigan (20-28%) combined.

Tax collected in April 2022:

- New Jersey = $20.5 million

- Michigan = $24.3 million

- Pennsylvania = $47.2 million

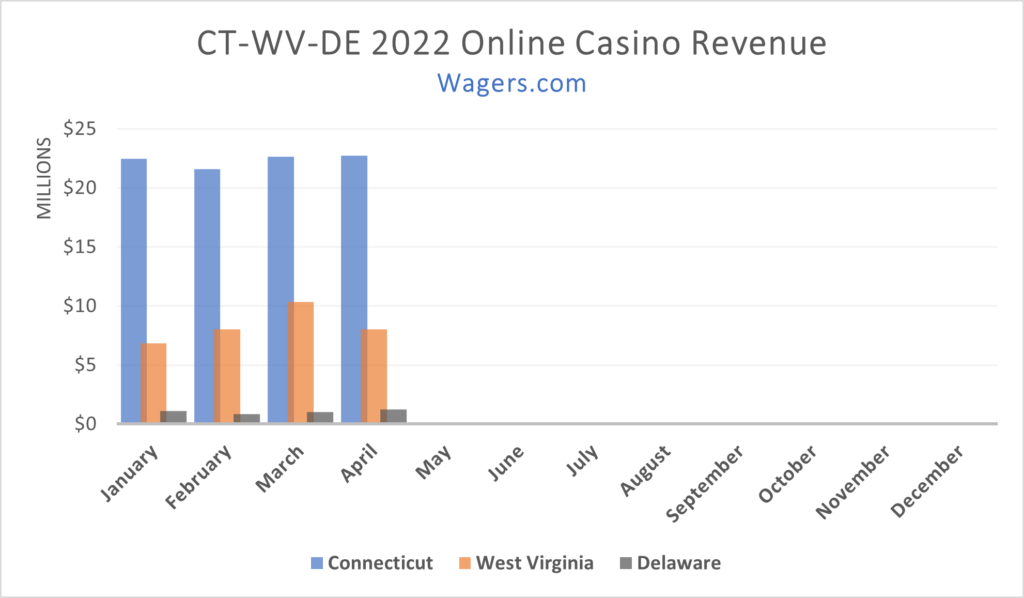

Connecticut, West Virginia, and Delaware Bring Up the Rear

The bottom three online casino states collectively produce less than a quarter of New Jersey’s revenue. Put another way, the total revenue generated by Connecticut, West, Virginia and Delaware ($32 million) is $15 million less than the tax Pennsylvania online casinos paid to the state in taxes.