It’s official, Michigan has joined the Multi-State Internet Gaming Association (MSIGA). Following regulatory approval, joining the MSIGA allows Michiganders to play in an interstate online poker pool with Nevada, New Jersey and Delaware.

The addition of Michigan to the MSIGA has raised many questions. In this column, we attempt to provide answers.

The Timeline

When Michigan online poker operators begin to pool players across MSIGA states is unclear.

Michigan Gaming Control Board Executive Director Henry Williams stated in the press release announcing Michigan’s entry into the MSIGA:

“The operators still have work to do before Michigan residents may join multistate poker games. The MGCB must make sure Michigan residents are protected when they play multistate poker, and we will apply the same rigor to review of the new offering as we have other internet games.”

Based on the timelines from previous mashups (13 months for Nevada and Delaware announcing their agreement and seven months from New Jersey announcing an MSIGA agreement to pooling), player pooling before the end of 2022 seems possible.

The timeline could be shorter, but the process dragging into 2023 isn’t out of the question either.

Michigan regulators have proven to be cautious. The state passed its gambling expansion law in December 2019, and its online sportsbooks and casinos went live in January 2021.

Further, while 888-WSOP.com has already gone through interstate testing in Delaware, New Jersey and Nevada, the other operators, PokerStars and BetMGM-partypoker, will have to undergo testing in each jurisdiction. That testing will take time and could slow down the process if Michigan wants to avoid giving WSOP.com a first-mover advantage.

The Impact

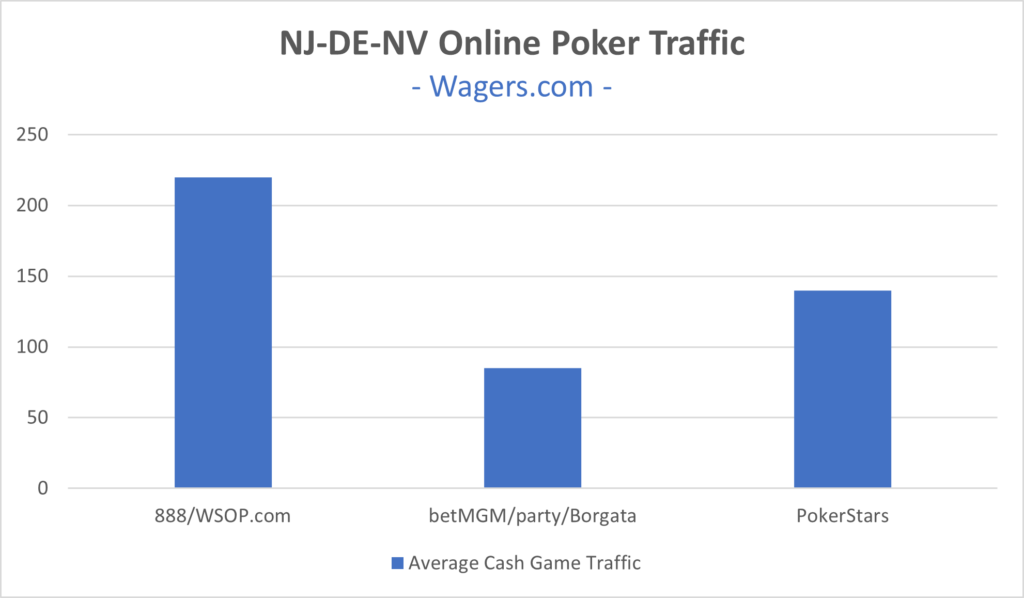

The addition of Michigan will radically alter the legal US online poker landscape. Currently, only 888/WSOP.com can take advantage of interstate player pooling, as 888 has a monopoly in Delaware and WSOP.com is the only active site in Nevada.

The advantage of pulling from multiple markets places 888/WSOP.com at the top of the US online poker hierarchy, per PokerScout.com.

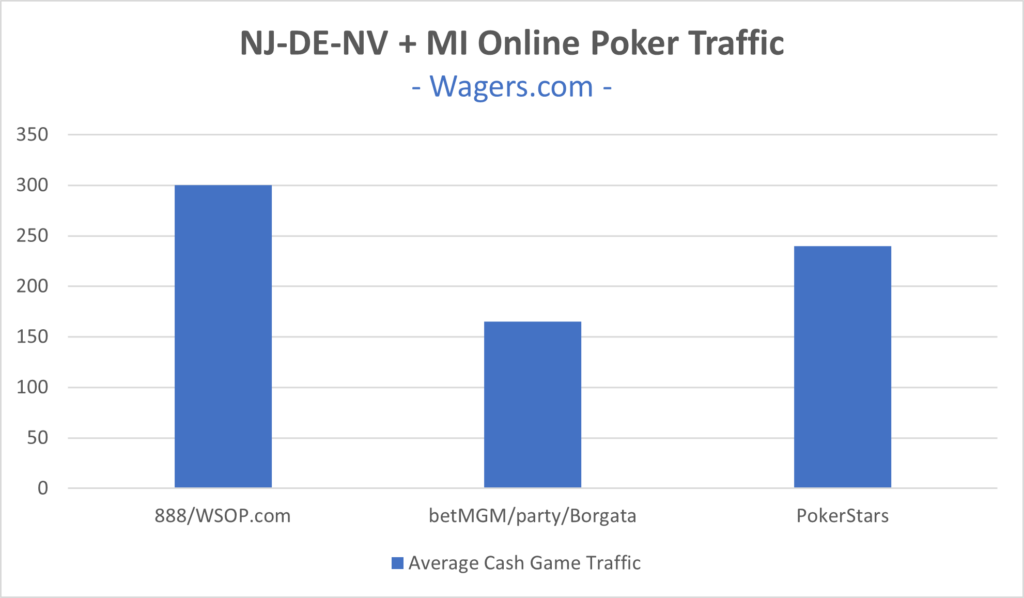

Here’s what the interstate player pools will look like based on the raw numbers in Michigan. The numbers in the chart below don’t account for players jumping from one site to another or the number of new players that might join.

Adding the player pools together doesn’t provide an accurate representation of interstate online poker following the addition of Michigan. For example, the 888-WSOP.com network has the largest player pool and, by extension, the most games. That helps bolster its numbers, even if players feel the software is inferior to PokerStars or party. So, as its peers close the gap, WSOP.com players might shift to its competitors as the player pool advantage evaporates.

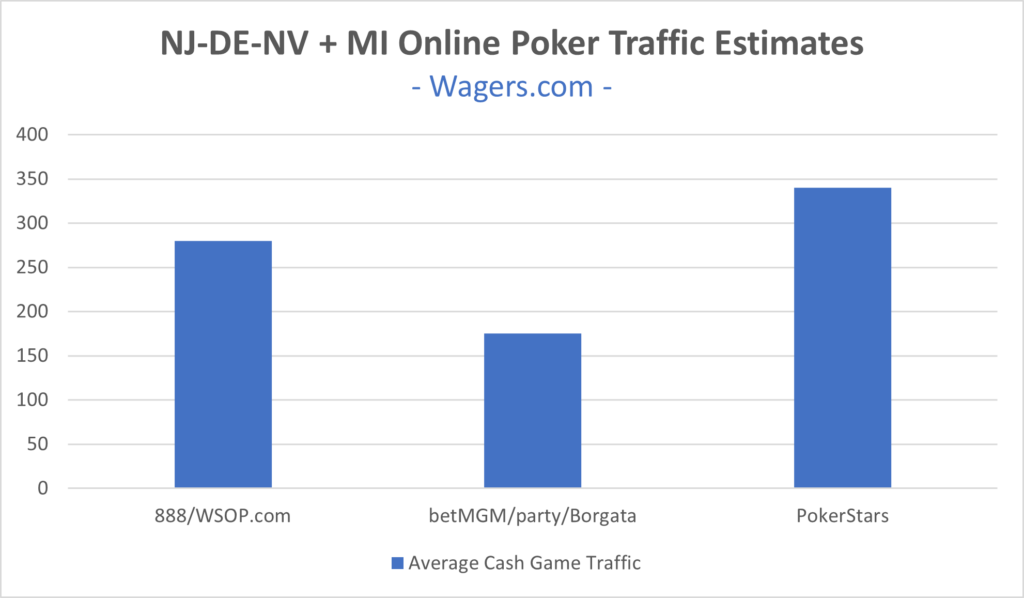

So, what should you expect when Michigan joins? My best guess is a slight uptick in poker traffic in each state and some cannibalization of WSOP.com New Jersey by its competitors.

Here’s what that might look like.

What About Pennsylvania?

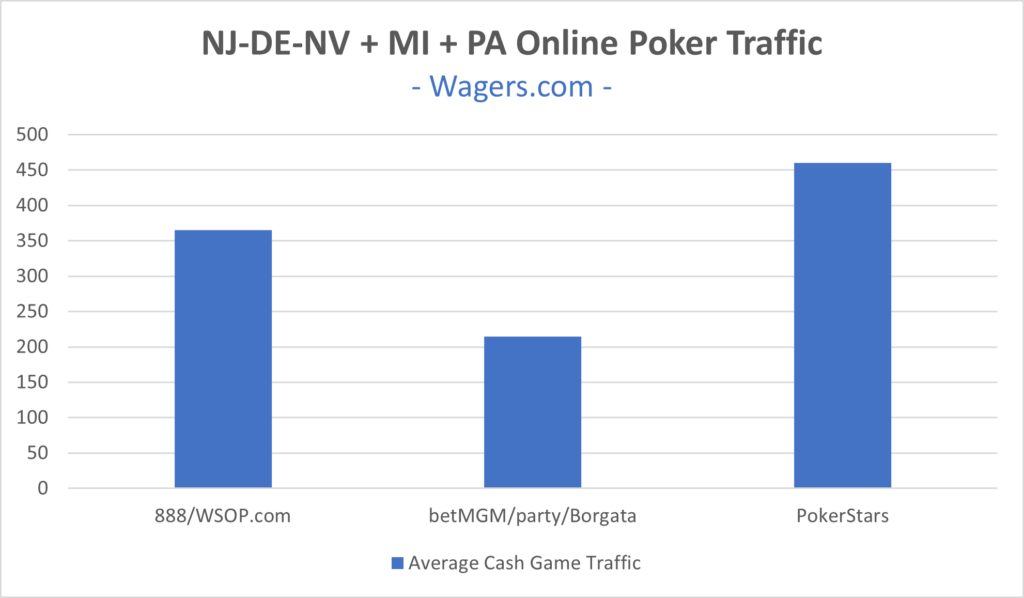

There is also hope that Michigan will produce a second-order effect in another legal online poker state: Pennsylvania.

There are already some rumblings that Michigan has increased the pressure on Pennsylvania to consider joining the MSIGA.

If Pennsylvania does follow suit, traffic at U.S. online poker sites would be on par with large European countries.

The above chart looks at the current combined traffic in these states. The numbers would increase as larger player pools attract more players to the virtual poker tables. Simply stated, liquidity begets liquidity.

And What About Connecticut and West Virginia?

Another possible second-order effect is the launch of online poker sites in Connecticut and West Virginia. Both states have legalized online poker (along with sports betting and online casino games), but operators have decided to put online poker on standby as neither state has a population base capable of supporting an online poker industry.

The belief is operators in both states are waiting for critical mass to be reached, at which point they can join the MSIGA and launch online poker sites.

And What About Other States?

These same dynamics (reaching critical mass) could drive conversations about legalizing online poker in other states. Presently, operators are ambivalent about online poker, preferring to focus their lobbying energy on sports betting and, to a lesser extent, online casinos. Except for a handful of states, online poker is a time and money sink when legalized at the state level.

Interstate online poker allows operators to pool players and utilize existing infrastructure in other states to lower costs. Online poker is also a proven acquisition channel, allowing operators to market casino and sports betting to the poker demographic.